Innovup and Assolombarda present the results of the second edition of the report that updates and deepens the analysis of the employment impact of innovative start-ups in Italy, looking at both those currently registered in the special section of the Register of Companies and those that have been registered there since 2012.

The Italian experience, in line with international findings, confirms that young and dynamic companies in our country make a decisive contribution to positive employment figures, demonstrating the strategic value of supporting innovative entrepreneurship in Italy too.

The report ‘The employment impact of innovative Italian start-ups between 2012 and 2024’, compiled by the Assolombarda Research Centre in collaboration with Assolombarda’s Life Sciences, Healthcare & Start-ups Division, analyses the 24,261 start-ups and former start-ups currently active in Italy. By 2024, these innovative Italian companies will have created a total of 68,526 jobs throughout Italy, up from 65,897 in 2023 (+4%), as well as almost 89,000 partners, for a total of more than 150,000 people. Over half of those in employment work in high-tech services and manufacturing, representing 4% of the Italian workforce in these sectors, which are considered fundamental for innovation and productivity.

Employment growth, which remained stable between 20% and 30% per annum from 2018 to 2023, has weakened in recent years, with an increase of 13% in 2023 and only 4% in 2024: a slowdown mainly due to a stabilisation in the number of active start-ups and ex-start-ups after several years of continuous growth. However, 80% of start-ups and ex-start-ups have maintained or increased their number of employees over the last financial year. Furthermore, the increase in employment in start-ups remains higher than in new non-innovative businesses: analysing the cohorts of start-ups created between 2018 and 2019, there was an increase in employees of 229% and 209% respectively in the first five years of life, a figure significantly higher than that of new businesses as a whole according to Istat (+113% in 2018) .

The more than 68,000 employees are particularly concentrated in a small group of start-ups. In fact, 92.4% of innovative companies are micro-enterprises, with fewer than 10 employees or even none at all in 56.7% of the companies analysed, while small and medium-sized companies with more than 10 employees, despite accounting for only 7.6% of the total, generate 67.3% of total employment.

In addition to employees, the number of individual members involved will rise to 104,687 in 2024, with a prevalence of individuals and families (88,800), while medium and large corporate investors will remain a minority.

On the other hand, there has been growth in the number of start-ups receiving investment from private equity funds, venture capital and incubators, which now stands at 993.

In terms of economic results, total turnover for 2024 is estimated at €14.5 billion, up from €13.4 billion in 2023, while added value will reach €3.7 billion (€3.3 billion in 2023). Productivity, measured as added value per employee, rises to almost €53,000, an increase of 47% compared to 2019.

Thirteen new ‘gazelles’, i.e. companies with increases in turnover or employees of more than 20% for three consecutive years in their first five years of life, also contributed to this performance. In total, there are 75 ‘gazelles’ still active in our country among start-ups and former start-ups, which by 2024 will have created 4,872 jobs, with an average size of 74 employees, and which also boast significant economic results, with an average turnover of €11.6 million and an average added value of €5.1 million.

In 2024, 1,440 start-ups and former start-ups ceased trading or went into liquidation or bankruptcy (excluding those that were acquired or merged), with a limited loss of 674 jobs. Only 4% of these companies had managed to exceed 10 employees, with an average turnover across the sample never exceeding €250,000. The mortality rate thus reached 6.0%, the highest value ever recorded, slightly up from 5.9% in 2023.

There were 116 acquisitions in 2024, a new record high, rewarding the best performing and most innovative companies, as confirmed by turnover figures, averaging €1.7 million in the year prior to acquisition, and employment figures, with over 10 employees in 28% of cases.

“The innovation chain is now one of the strongest drivers of Italian growth: not only because of its ability to generate new ideas, but also because it produces skilled labour, new skills and value for the entire production system. The data,” says Federico Chiarini, president of Assolombarda Young Entrepreneurs, in a statement, “show that start-ups, innovative SMEs, incubators, accelerators and science parks are the protagonists of a profound transformation that is affecting the economy and society. But for this potential to become fully realised, a change is needed. Italy is a country rich in savings, yet too little of that capital is allocated to the real economy. We must have the courage to channel it towards innovation, because that is where future growth is built. Alongside investment, we need stable, clear and long-term rules: only in this way can we give confidence to entrepreneurs and ensure the continuity of policies such as the Scale-up Act. Innovation is not a niche, but a pillar of the country’s stability.

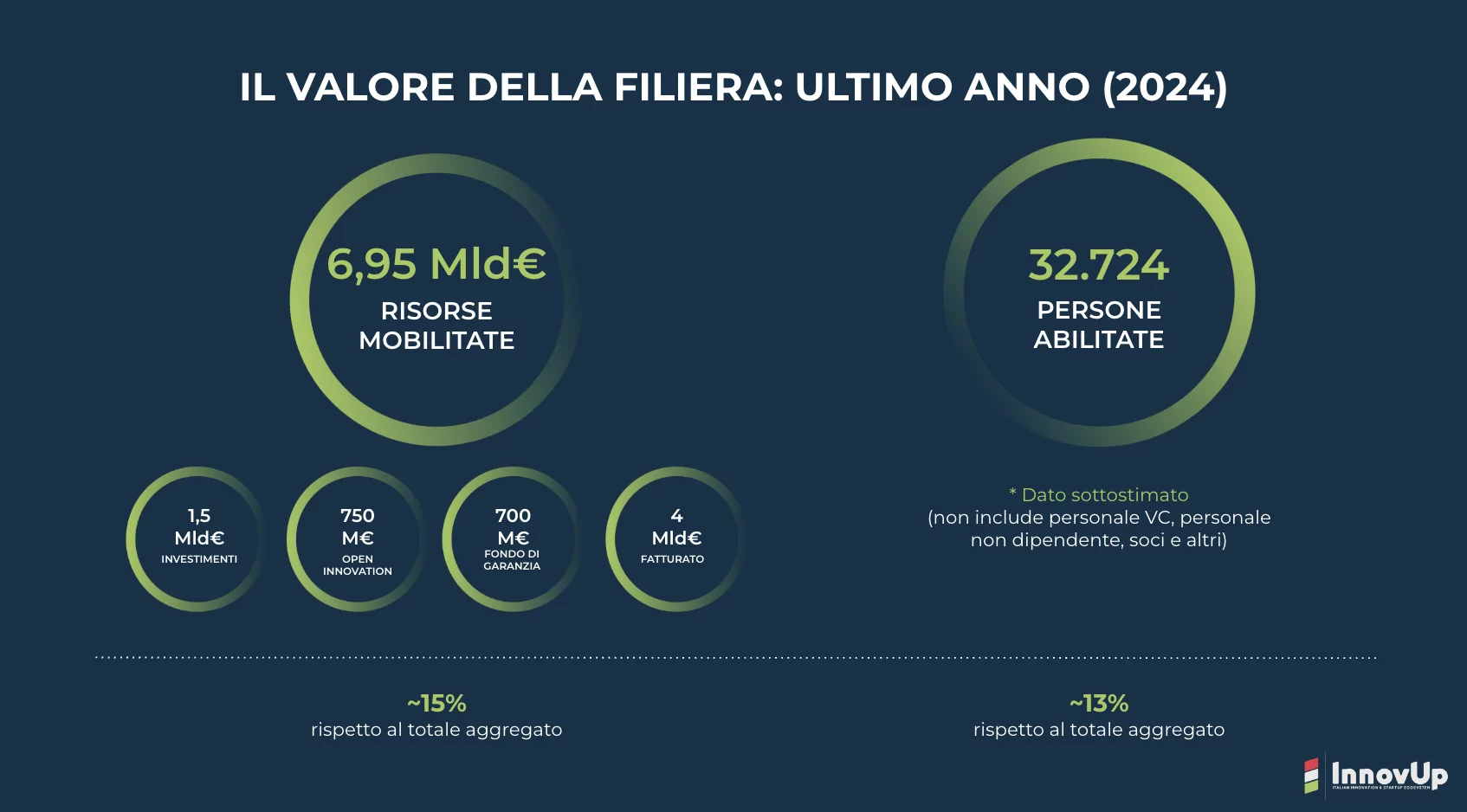

Based on Assolombarda’s research ‘The employment impact of innovative Italian start-ups (ed. 2025)’ and aggregating data from several important studies and research in the sector, the Innovup Association estimates that in 2024, the Italian innovation supply chain will have mobilised resources worth a total of €6.95 billion. This figure includes €1.5 billion in venture capital investments, €750 million dedicated to open innovation, €700 million in loans guaranteed by the Guarantee Fund and €4 billion in turnover generated by the entities involved. These resources have enabled 32,724 people to be employed.

In the long term, over the decade from 2012 to 2024, the value generated by the Italian innovation chain will reach €46.95 billion. During these years, the number of people enabled by the innovation system will reach 243,632. In detail, venture capital investments in innovative Italian start-ups amounted to approximately €9.2 billion, while the open innovation services market reached €3.75 billion, thanks to an increasingly collaborative system between companies, incubators, accelerators and innovation centres.

Furthermore, the Guarantee Fund remains a crucial tool for supporting the innovative supply chain: between 2012 and the first quarter of 2025, 19,647 transactions were managed for innovative start-ups, with 17,159 loans granted, amounting to €3.8 billion in resources actually disbursed and €3.1 billion guaranteed. For innovative SMEs, 9,171 transactions were managed during the same period, with 8,379 loans, €3.1 billion disbursed and €2.4 billion guaranteed.

Overall, turnover in the innovation sector from 2012 to 2024 amounts to €27.1 billion. The same period sees the presence of 32,337 innovative start-ups, capable of generating a total turnover of €14.5 billion.

“These figures testify to the quantum leap that the Italian innovation chain has made in recent years. The impact on qualified individuals shows that the sector is increasingly mature and plays a leading role in the country’s employment and competitiveness. The challenge now is to capitalise on these results by continuing to support investment policies, support tools and collaboration between the public and private sectors, so that we can generate even more widespread value across the country and concrete opportunities for the labour market,” commented Chiara Petrioli, president of Innovup and CEO of scaleup WSense.

From an employment perspective, these start-ups have created 68,526 jobs and involved 104,687 separate partners. The jobs created by start-ups account for 4% of Italian employment growth in the period 2012-2024. Employment growth in the first five years of life of startups and former innovative startups was +219%, while for new businesses as a whole, growth stood at +113%. These figures confirm the key role of new businesses, even when compared internationally: in the United States, between 1977 and 2005, new businesses generated over 3 million jobs each year, while in Italy, companies less than five years old account for about half of new jobs and contribute 64% of new national employment recorded in 2021.

The Italian supply chain structure is completed by 3,026 innovative SMEs, which generate €8.9 billion in turnover and employ 55,000 people. There are also 239 certified incubators and accelerators, which between 2016 and 2023 achieved €3.2 billion in aggregate turnover and employed 14,329 people. Alongside them are 56 start-up studios and venture builders with €30.5 million in turnover and 490 employees (2024 data), and 55 Science and Technology Parks, which are true hubs for innovation in the country.

Finally, tax breaks for innovation benefited a total of 12,248 recipients, for a total value of approximately €115 million, considering 30% deductions until 2022 and de minimis deductions until 31 October 2024.

“Europe is at serious risk of being crushed by the United States and China in the global battle for innovation. We are losing ground and cannot afford to remain spectators,” comments Maria Anghileri, president of Confindustria’s Young Entrepreneurs. – That is why we must push decisively for an Italian Youth Deal: a package of measures that includes tax incentives, simplifications, subsidised loans, direct grants and equity, to unleash the potential of the younger generation and our innovative businesses. At European level, our Youth Deal is consistent with the new EU Startup and Scaleup Strategy, which aims to make Europe once again an ideal place to launch and grow global technology companies. Among the most eagerly awaited measures is the so-called 28th Regime, which must become a matter of urgency. It is clear that simplifying bureaucracy in Italy and Europe is an essential condition for truly competing at a global level.

ALL RIGHTS RESERVED ©