Table of contents

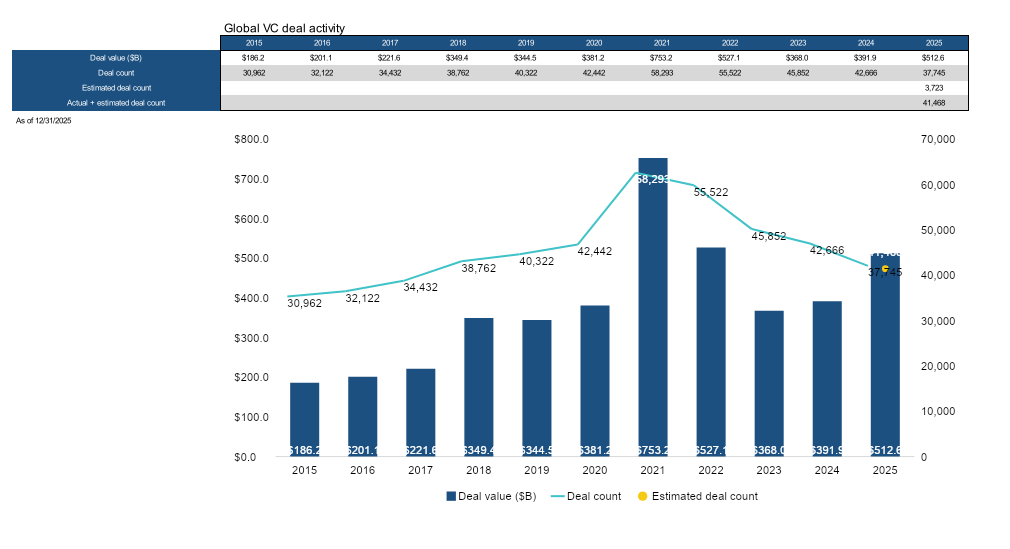

The value of transactions completed in the global venture capital market in 2025, amounting to $512 billion, increased significantly compared to the previous two years and almost equalled the 2022 figure, the second highest ever recorded. Artificial intelligence accounted for over 52.7% of the total value of transactions during the year and 31.4% of completed transactions. In its preliminary analysis, Pitchbook summarises the 2025 trend in relation to global venture capital investments and also provides an analysis by geographical area in Europe, Asia and the US, which further allows us to get a complete picture and begin to identify possible trends for 2026, which has just begun.

The total value of venture capital exits, amounting to $549.2 billion, increased by $212 billion, which is a positive development for venture capital, given that the market has experienced several years of low liquidity. Stock market listings accounted for approximately 10% of exits and over 50% of their total value. Several high-profile listings boosted the total value of exits, although the number of completed listings, at 344, was lower than in 2024.

Globally, venture capital fundraising remains difficult due to poor exit performance in recent years. Only $118.6 billion in new commitments were closed, nearly $100 billion less than in 2024. The number of new funds closed in 2025 was also the lowest in a decade. This will have an impact on markets in the future. Those with liquidity will be able to support trading activity, while those who have been unable to generate new capital will find it difficult to close deals.

Preliminary analysis of European VC

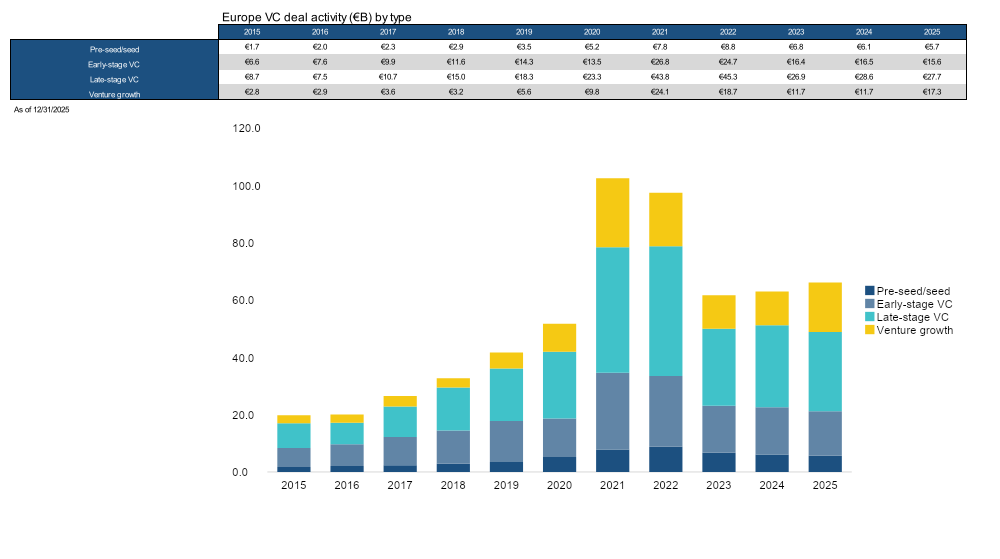

The value of European VC deals remained largely unchanged year-on-year, reaching €66.2 billion in 2025. The figures for VC transactions in 2025 slightly exceeded those for 2024, indicating a mixed market showing signs of positivity combined with ongoing challenges. The number of transactions for 2025 points to further stability, with an estimated total of 10,206 in 2025 compared to 10,674 in 2024.

Activity was supported by fewer rounds of funding, but these were larger and at a more advanced stage. At the sector level, artificial intelligence drove growth in transactions in 2025. AI-related transactions now account for 35.5% of the value of transactions in Europe, making the ecosystem increasingly dependent on AI-related activities. Outside of AI, several vertical sectors are attracting varied attention, and regional geopolitical dynamics have evolved in 2025. Both of these factors could create opportunities in 2026.

Like the value of transactions, the value of European VC exits in 2025 has also increased slightly compared to the previous year. The estimated number of exits remained unchanged between 2024 and 2025. Exit activity returned to levels similar to those of recent years, apart from the notable increase recorded in 2021. The large listings of Klarna and eToro contributed significantly to the 2025 exit figure.

In 2025, fundraising by European VCs recorded its weakest result in a decade. Fundraising declined sharply after peaking in 2022, and 2025 was the fourth consecutive year of declining fundraising rates. Fewer fund closings and lower capital raised highlight the current difficult landscape for GPs. Distributions are under pressure, resulting in less capital available for new fundraising initiatives.

Preliminary analysis of the VC market in Asia

2025 ended with a strengthening of dealmaking activity in Asia, with transaction value in the fourth quarter reaching $20.3 billion in each of the last two quarters, the two quarters with the best figures of the year. Transaction value for the whole of 2025 reached $76.3 billion, the lowest since 2020. Nearly 40% of capital was invested in the fourth quarter, signalling a year-end acceleration after several years of decline. The number of transactions declined by more than 10% year-on-year to 11,389, with a more pronounced decline in the fourth quarter, indicating greater selectivity and concentration of capital rather than a generalised recovery.

Investments related to artificial intelligence accounted for nearly 20% of the number of venture capital deals and 17% of the value of deals in 2025, maintaining momentum despite a more general slowdown in venture capital. However, AI’s share of Asian venture capital activity remained below US and European levels, reflecting a more measured pace of implementation. Capital was concentrated in later-stage rounds, with the median value of Series C deals in the AI sector reaching $34.6 million, approximately 70% higher than non-AI counterparts, highlighting increasing capital intensity in the expansion phase.

Exit activity improved in 2025, increasing by more than 50% compared to the previous year’s figures and reaching $150.2 billion, but still remaining well below peak levels for the cycle. Liquidity conditions improved unevenly, with IPO markets remaining selective and mergers and acquisitions continuing to dominate, driven largely by strategic buyers in a context of limited exits.

Exit activity in China remained modest, reflecting a continuing structural realignment towards domestic capital and limited participation by international investors. On the other hand, India and Japan were relatively positive spots. India benefited from a more functional domestic IPO market and local institutional liquidity, while corporate governance reforms and divestitures in Japan supported a high level of M&A activity.

Fundraising fell to $33.2 billion, the lowest total in the last decade. This total was concentrated in just 394 funds, a sharp decline from the 829 funds that raised capital in 2024, highlighting a much more selective fundraising environment in which capital was concentrated among a smaller number of managers.

Fundraising conditions remained uneven across the region, with domestic institutional capital playing a more prominent role in Japan, India and Australia. Meanwhile, cross-border fundraising, particularly for China-focused strategies, remained limited due to policy divergences and poor visibility on exits. Incremental improvements in liquidity were not sufficient to significantly reduce fundraising timelines, keeping limited partners (LPs) selective through 2026.

Preliminary analysis of the United States (PitchBook-NVCA Venture Monitor collaboration)

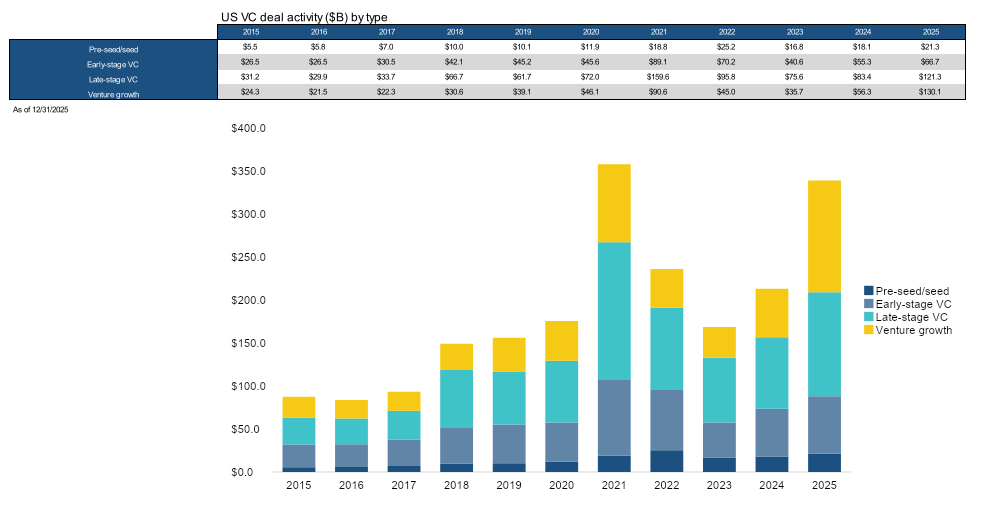

2025 ended with a strong recovery, with the fourth quarter seeing the highest number of deals completed since the first quarter of 2022. With two quarters exceeding £91 billion in deal value, 2025 closed with the second-highest annual value ever, just £18.8 billion less than 2021. The overall increase in the number of deals is a positive sign for the market, even if it diverges from expectations based on low fundraising by GPs (general partners) and low liquidity figures in recent years. More than £5 billion has been invested in pre-seed and seed deals over the last three quarters, a strong signal that early-stage investors are ready and willing to reinvest. At £25.7 billion, the value of early-stage deals in the fourth quarter reached its highest point since the fourth quarter of 2021.

With approximately 16,707 deals completed in the United States, the number of deals in 2025 increased by 9.6% compared to the previous year, with much of that increase driven by investments in artificial intelligence. Overall, AI companies accounted for 65.4% of the total value of deals for the year and 39.4% of completed deals, setting new records for AI investment in each category. Since the launch of ChatGPT in late 2022, AI investment has grown from £73.0 billion that year to £222.1 billion in 2025, with a 24% increase in the number of deals during that period.

US VC exit activity saw a significant increase in 2025, with approximately 1,636 exits completed during the year, an increase of 28.5% compared to 2024. The total value of exits also rose sharply, with $297.8 billion representing a 92.7% increase over the previous year. However, this figure represents only 34.5% of the annual record set in 2021.

Although high-profile IPOs changed the narrative on liquidity for a time, the total number of public listings remained unchanged from 2024 to 2025, with only 67 transactions completed, including IPOs and reverse mergers. Public listings remained in second place in terms of liquidity value, with mergers and acquisitions nearly reaching their 2021 peak of £152.1 billion, while the value of M&A exits in 2025 reached £140.7 billion. Groq’s £20 billion licensing agreement at the end of December boosted the value of mergers and acquisitions, even though the deal was not a standard acquisition.

Venture capital fundraising in the United States fell to its lowest level since 2019, with only £66.1 billion in new commitments closed during the year. With 537 funds, 2025 also saw the lowest annual total of new funds in the last decade. These figures represent a significant decline from the record $222.9 billion in commitments and 1,777 new funds in 2022.

LPs remain wary of the lengthening of VC liquidity cycles, as a large number of companies remain private well beyond traditional timelines. The relative increase in liquidity should help fundraising in 2026, although a significant increase in new commitments is unlikely.

ALL RIGHTS RESERVED ©