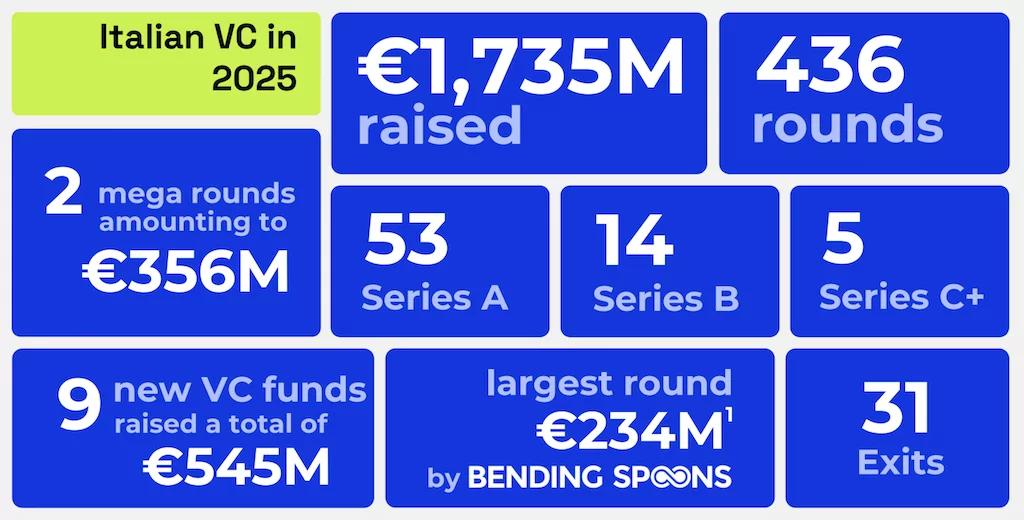

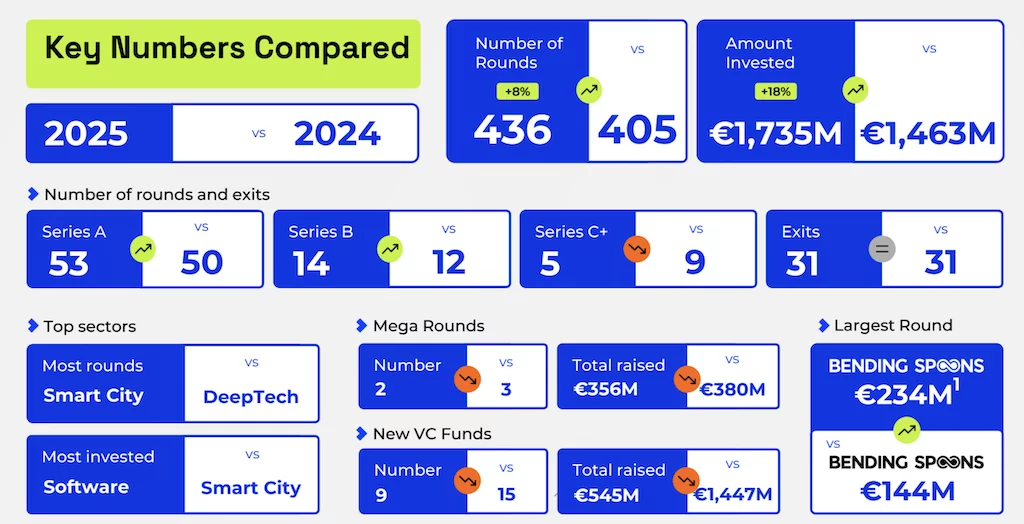

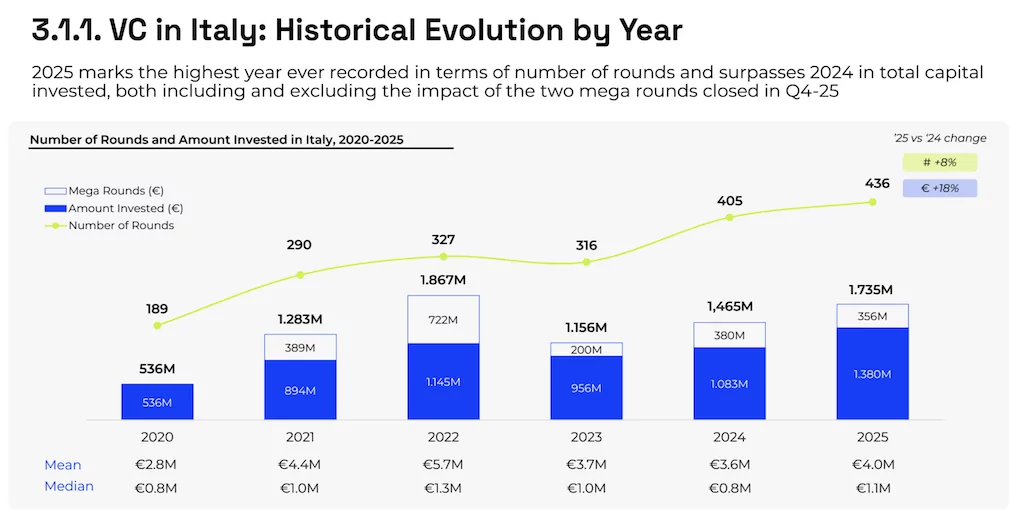

In 2025, investments in start-ups and innovative companies in Italy reached €1.735 billion, distributed across 436 investment rounds. The year just ended ranks as the second best ever in terms of amount invested, just behind 2022, and, if mega rounds are excluded, it becomes the best ever. Ten rounds exceeding €25 million (absent in the first half of the year) were concentrated in the second half of the year and contributed to a significant increase in the total capital raised. In particular, Q4-25 was the best quarter ever in terms of investment amount, with €901 million raised compared to €316 million in the previous quarter. The number of rounds also rose: 122 compared to 105 in Q3-25. In 2025, Italy saw the launch of nine new funds for a total of €545 million raised, a significant decline on 2024.

This is the scenario outlined by the Quarterly Observatory on Venture Capital in Italy, produced by Growth Capital in collaboration with Italian Tech Alliance. Now in its fifth year, the Observatory monitors quarterly investment performance and trends in the venture capital ecosystem in Italy.

The data was presented at an event attended by Davide Turco and Francesco Cerruti, respectively president and general manager of Italian Tech Alliance, Fabio Mondini de Focatiis and Giacomo Bider, respectively founding partner and senior associate of Growth Capital, Paola Pozzi, partner at Sofinnova Partners – Telethon Strategy, David Bassani, founding partner at Maia Ventures, and Claudio De Luca, founder and CEO of Nanophoria.

The analysis

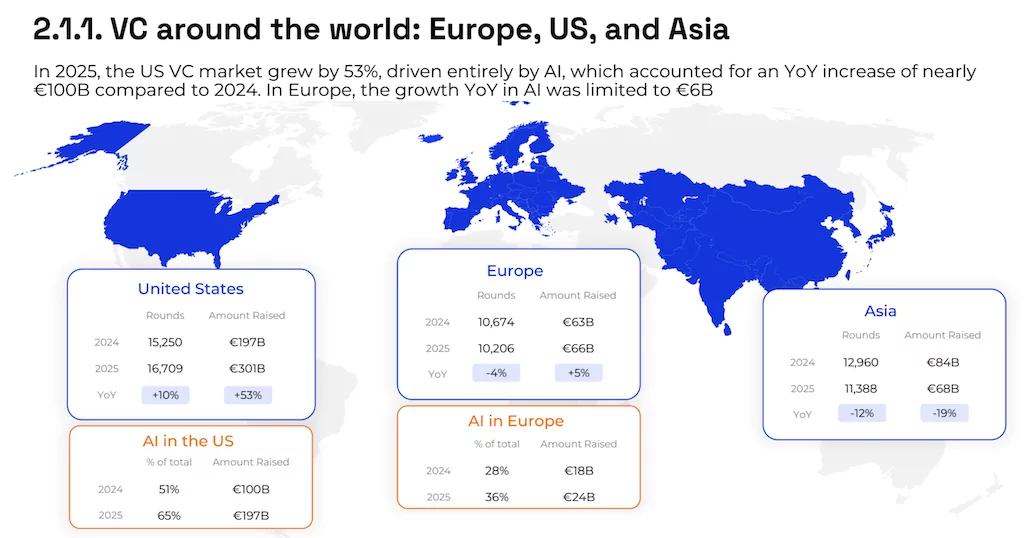

At European level, 10,206 investment rounds were closed in 2025, raising a total of €66 billion, confirming solid resilience in terms of value (+5% compared to 2024). Over the last three years, both the total amount invested and the weight of mega rounds have remained largely stable. The number of rounds in 2025 was also in line with the previous year, recording a slight decline of -4%. Exit activity remained solid in terms of value, supported by a number of high-profile deals and significant IPOs. However, the number of transactions reached historic lows, reducing the overall liquidity of the venture capital market.

Fundraising by European VC funds fell to a record low, reflecting smaller fund sizes, fewer large closings, a growing role for emerging managers and a significant geographical rebalancing, with the DACH region overtaking the UK as the main hub for capital raised by funds.

However, the United Kingdom remains the leading European market in terms of investment volume, despite recording limited growth this year. France also experienced a year of relative underperformance, only partially mitigated by the strength of the AI sector, while Spain showed positive signs, with investments exceeding €2 billion for the first time since 2022. In 2025, Italy, with €1.735 billion raised in 436 rounds, stands out as the country (with a VC market exceeding €1 billion) with the strongest annual growth after Finland, Ireland, Spain and the Netherlands. From 2020 to today, VC investments in Italy have tripled in size: this is the best result in terms of growth among European ecosystems.

Considering the segmentation of rounds by type, in 2025 in Italy, Series A rounds remained stable at 53, while Series B rounds were limited to 14. The growing trend in bridge rounds continues, while in terms of amount invested, seed rounds are gaining weight in 2025 at the expense of Series B+ rounds. This, combined with the decline in Series C+ rounds compared to 2024, confirms that the late stage continues to represent the main bottleneck in the Italian venture capital ecosystem. Confidential rounds had a significant impact on both the number of transactions and the capital invested, while larger transactions often included debt and/or secondary components.

With the exception of AXA’s notable acquisition of Prima, M&A activity remains limited in terms of value, with only 31 transactions in 2025. No IPOs were recorded in 2025, highlighting the complexity of the exit scenario in Italy.

The sector analysis for 2025 sees smart cities in the lead with 71 rounds, followed by software, deep tech and life sciences, with 62, 60 and 58 rounds respectively. Fintech ranks fifth with 43 rounds. Looking at the historical analysis of the last five years, there has been a gradual evolution in various sectors, with different dynamics from year to year rather than uniform growth patterns, with the smart city sector consolidating its leadership position. Looking at the amount raised, 2025 sees the software sector on the podium with 494 million, followed by life sciences (417) and deep tech (269). Looking at the last five years, the sectors that have seen the most growth are life sciences and software, followed by deep tech. Fintech and smart cities have seen annual peaks mainly due to mega rounds.

Among the top five deals of 2025, Bending Spoons (234 million Growth VC) ranks first, followed by AAvantgarde (122 million Series B), Exein (100 million Series C), NanoPhoria (83.5 million Series A), and Exein (70 million Series C).

In 2025, Italy recorded a peak of 354 active investors. International participation reached 46%, up from 24% in 2020, driven mainly by investors from the United States and the rest of Europe. This year again, there is a strong correlation between the size of the rounds and the ability to attract international capital. All transactions exceeding €20 million involved at least one foreign investor.

In terms of fundraising, the €545 million raised in nine new funds marks a slowdown in 2025 compared to the record results of 2024, but still continues to make a significant contribution to the ecosystem’s current level of dry powder. During 2025, there was increased activity from vertical funds and first-time VC operators.

During the event, the updated VC Index, created by Growth Capital in collaboration with Italian Tech Alliance, was also presented. It is an indicator on a scale of 1 to 10 calculated every six months and which provides an indication of the stage of development of the VC ecosystem in Italy and the sentiment of its players. The VC Index reached an all-time high in December 2025, buoyed by strong activity in the second half of 2025 and a recovery in sentiment among innovation sector players, who perceive a rebalancing of power in negotiations between founders and investors.

As expected, the exit issue remains the main critical factor for the Italian VC ecosystem. Italy is showing important signs: 2025 has surpassed 2024 in terms of both rounds and amount invested, and Q4-25 was the quarter with the highest amount ever invested, driven by the return of rounds larger than €25 million. The presence of international investors has also strengthened, reaching 46%. However, limitations remain evident in the late stage where, despite an average of 50 Series A rounds per year, Series B rounds remain few and Series C+ rounds have decreased. There is also a structural lag in AI compared to Europe and, even more so, the US. The real challenge for Italy will be to convert the early-stage pipeline into a more consistent flow of late-stage and exit deals,” comments Fabio Mondini de Focatiis in a note.

“2025 was a year of positive consolidation for the Italian innovation ecosystem. The data show growth, supported in particular by the excellent performance in the fourth quarter, although there is still an urgent need to close the gap with the more advanced markets,” says Davide Turco. “Another positive note comes from the growing number of success stories in terms of fundraising, which testify to the quality of Italian founders and researchers, representing a credible showcase for international investors. On the policy front, there are both positives and negatives. The regulatory measures put in place to attract institutional capital are heading in the right direction but have had a limited impact so far, work on the Consolidated Startup Law has stalled, and some key measures, such as tax credits for investments in startups and innovative SMEs, have been suspended for the time being. At the European level, too, concrete progress is slow in coming. We will work to ensure that the enthusiasm and commitment of the players in the ecosystem translate into concrete opportunities for the sector.

ALL RIGHTS RESERVED ©