The Azimut Group announces the finalisation of a €110 million club deal dedicated to investing in D-Orbit, a leading Italian company in orbital logistics services and infrastructure for space operations. The club deal reached its fundraising target in less than two weeks, confirming investors’ high level of interest and confidence in this opportunity.

The investment was made through Azimut Direct Investments SCA-SICAV-RAIF – D-Orbit, a dedicated Luxembourg vehicle that enabled approximately 1,500 clients served by Azimut’s network of financial advisors and wealth managers in Italy to access an investment initiative in the space infrastructure sector, one of the most strategic areas for the development of the new global space economy.

The structure of the transaction involves participation in an ongoing capital increase, with Azimut as lead investor, aimed at supporting D-Orbit’s industrial and technological expansion, accompanied by a purchase of shares on the secondary market by various investors, aimed at strengthening the shareholding structure and consolidating the company’s international growth path.

Founded in 2011, D-Orbit is one of the global pioneers in space logistics and today, thanks to its advanced engineering vision and solid industrial capabilities, represents one of the major technological success stories of contemporary Italy in the space sector. It has established itself as an international benchmark in satellite transport and deployment services, consolidating its international presence with activities in Europe, the United States and the United Kingdom and initiating collaborations with leading space agencies and private operators of global significance.

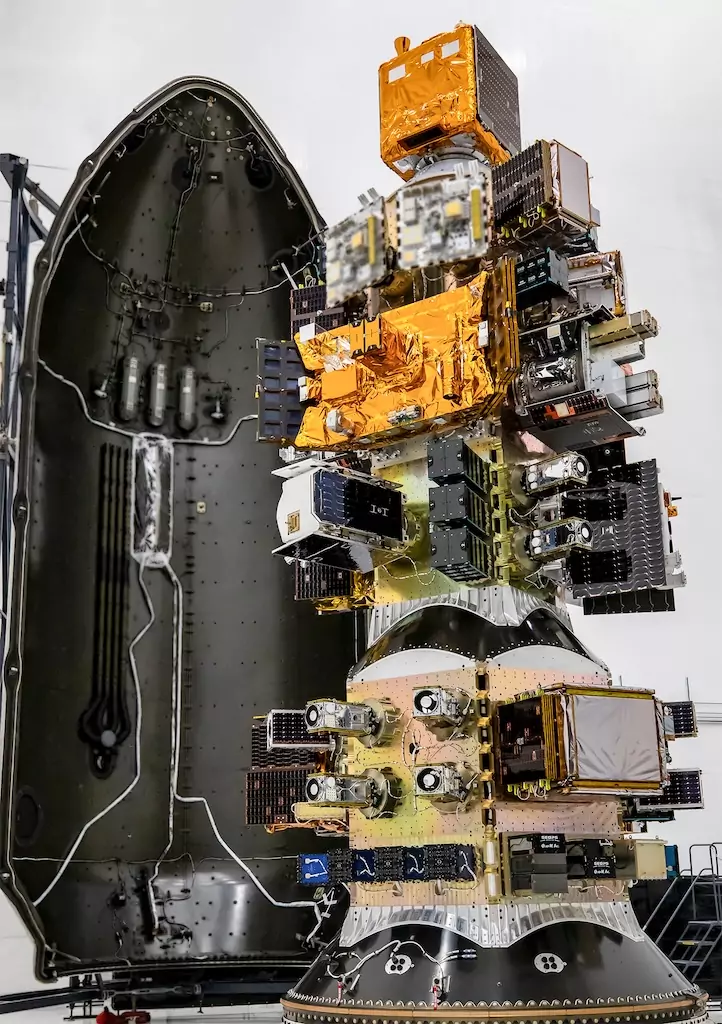

The Company’s flagship product, ION Satellite Carrier, is a platform that enables the precise release and positioning of satellites in orbit, significantly reducing mission time, cost and complexity. ION is part of a family of satellite platforms developed by the company to meet the growing demand for satellite constellation services, which are now essential for applications such as advanced telecommunications, Earth observation, climate analysis, defence, autonomous mobility and critical infrastructure management.

Starting in 2026, the space economy will enter a phase of rapid acceleration, with the number of satellites in orbit set to grow significantly over the next decade and an ever-increasing demand for orbital positioning services, space logistics and in-orbit operations management. In this scenario, companies such as D-Orbit are taking on an increasingly important role within the space ecosystem, contributing to the development of services and capabilities that will have a growing impact on security, industrial competitiveness and the provision of global digital services.

The resources provided by the club deal will be used to support D-Orbit’s international development, expand its industrial capacity related to ION missions, and continue its technological roadmap, further strengthening the company’s global positioning.

Giorgio Medda, CEO of the Azimut Group, commented in a statement: “The success of this new club deal once again confirms Azimut’s ability to bring private clients closer to the greatest opportunities in the real economy, positioning us as an enabler and accelerator of strategic technological innovation in our country. D-Orbit is an example of Italian industrial excellence capable of establishing itself as an international benchmark in the construction of new global space infrastructure. Supporting its growth means investing in the future of Europe and Italy’s technological competitiveness.”

Luca Rossettini, CEO of D-Orbit, says: “Azimut’s entry as lead investor represents a strong sign of confidence in the industrial and technological path that D-Orbit has been pursuing for over ten years. This initial closing strengthens our ability to continue growing with a long-term vision, maintaining a solid industrial approach consistent with the challenges of a rapidly evolving sector. It is a step that encourages us to continue with determination, building value over time together with partners who share the same perspective.

ALL RIGHTS RESERVED ©