Tulum Energy, a startup innovating in the field of methane pyrolysis, announces that it has closed a $27 million venture capital financing round. This investment, led by CDP Venture Capital (through the Green Transition Fund), TDK Ventures and a global consortium of investors including TechEnergy Ventures, MITO Technology, through the MITO Tech Ventures fund, and Doral Energy Tech Ventures. , emphasises confidence in Tulum Energy’s innovative approach to clean hydrogen production.

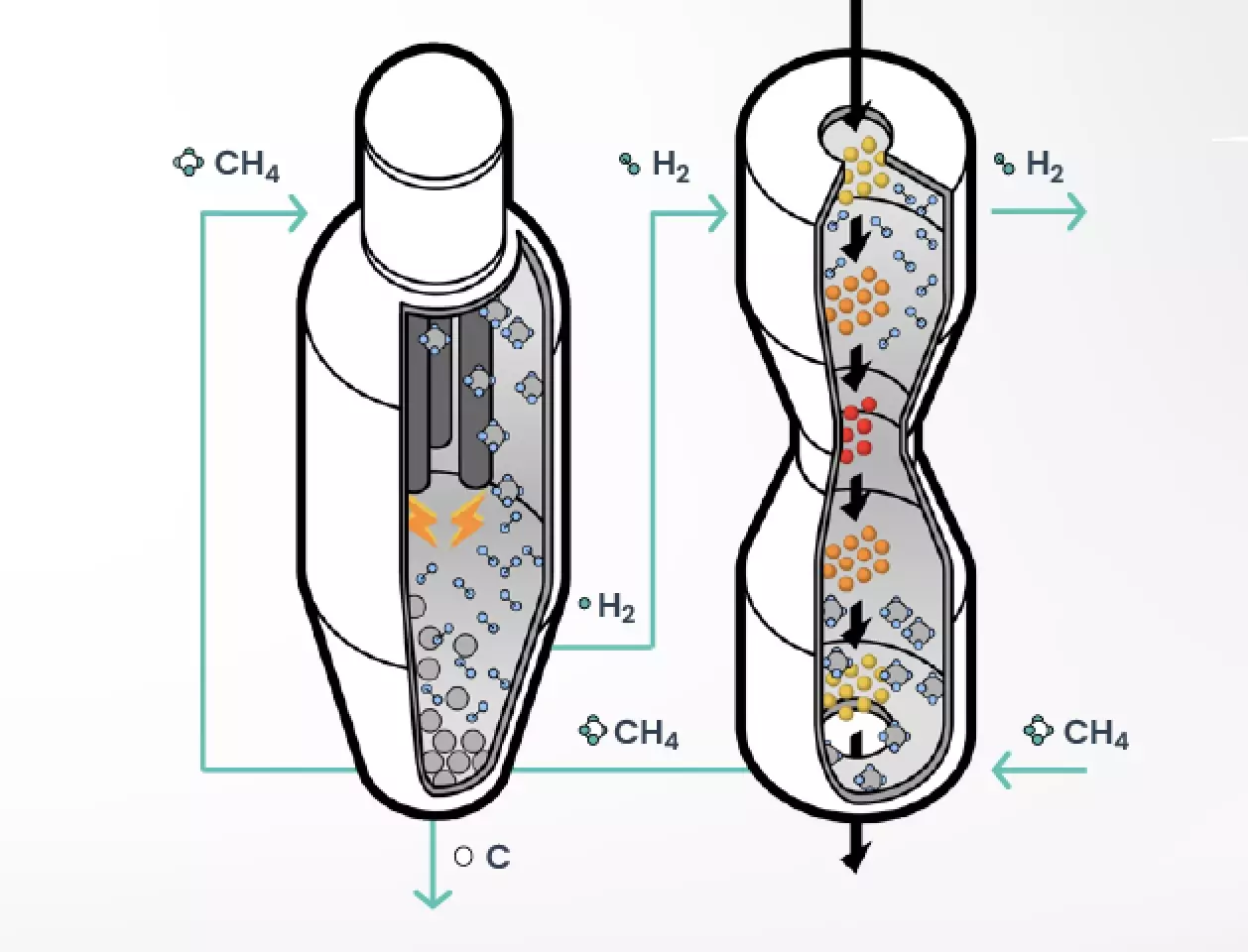

Tulum Energy is committed to developing a new methane pyrolysis technology. Methane pyrolysis is a chemical process that involves the production of clean hydrogen (turquoise) and solid carbon using natural gas or biogas as raw materials, without CO2 emissions. Methane pyrolysis can overcome the economic and infrastructural limitations of green and blue hydrogen in the industrial production of decarbonised hydrogen. “The distinctive feature of our technology is its unrivalled combination of high scalability and exceptional energy efficiency,” said Massimiliano Pieri, CEO of Tulum Energy, in a statement. – This allows us to meet the significant needs of large industrial consumers of hydrogen, such as refineries, ammonia producers and chemical plants, at truly competitive costs, even without resorting to tax credits and incentives. The main innovation lies in the reuse of existing, commercially available machinery in the steel industry to produce turquoise hydrogen. Essentially, we are repurposing an electric arc furnace as a high-temperature heat source to split methane molecules, obtaining clean hydrogen and valuable solid carbon instead of smelting iron.

The proceeds from this round of financing will be strategically allocated to the construction of the company’s pilot plant in Pesquería, Mexico, located within the industrial complex of Ternium, one of the leading steel producers in the Americas. “Ternium is the perfect partner to host our initial operations,” adds Pieri. “They are interested in using our hydrogen for direct reduced iron (DRI) production and have the solid infrastructure we need for seamless scalability.” The company will launch Tulum Energy’s Italian subsidiary in Milan, which, leveraging Italian supply chain and manufacturing talent, will serve as a central hub for research, development and engineering for the pilot plant and subsequent commercial plants that Tulum will develop.

TechEnergy Ventures, the venture capital division of Tecpetrol, an energy company, has meticulously built Tulum Energy since its inception, starting from an idea by Tenova, which manufactures electric arc furnaces and DRI furnaces designed for H2, two key technologies for accelerating the decarbonisation of steel. In 2022, TechEnergy Ventures entered into a strategic partnership with Tenova, which transformed the idea into a fully-fledged company, securing intellectual property, bringing together the core team and providing the initial financial resources to launch a solid business plan. “Having a CVC with venture building capabilities allowed us to adopt an investor mindset from day one, enabling us to build a company that would be highly attractive to global investors from the outset,” says Alejandro Solé, CIO of TechEnergy Ventures.

Tenova’s role as a technology partner offers Tulum Energy a significant competitive advantage, thanks to its deep industrial experience and access to an established supply chain for equipment procurement and implementation. Tenova will also actively support Tulum’s commercial efforts by providing access to its extensive industrial customer base. “We began working on the concept of reusing an electric arc furnace as a result of internal experiments and our in-depth knowledge of EAFs,” adds Paolo Argenta, EVP of Tenova’s Upstream business unit.

Pieri highlights the company’s accelerated roadmap: “Because we are leveraging existing components and Tenova’s established supply chain, our technological and commercial path will be highly efficient in terms of time and capital. After the pilot phase, we will proceed directly to the construction of our first large-scale commercial plant.”

CDP Venture Capital’s objective with this investment is to support the establishment of the Italian subsidiary in order to strengthen the production chain and the excellence of the research and development process. In this way, CDP Venture Capital will not only support the company’s development but also facilitate access to additional capital, strengthening Tulum Energy’s long-term financial solidity.

“Tulum Energy’s scalable and efficient methane pyrolysis technology represents a breakthrough for industrial decarbonisation. Our investment fully reflects our mission and commitment to innovative solutions that drive the green transition in hard-to-abate industrial sectors, where decarbonisation remains particularly challenging at national, European and global levels. This initiative also recognises the excellence of Italy’s specialised manufacturing supply chain, which plays a key role in the production of the technology components used to build the pilot plant,” says Cristina Tomassini, head of CDP Venture Capital’s Green Transition Fund.

TDK Ventures, TDK’s venture capital division, will facilitate access to TDK’s expertise and electronic products, as well as its extensive network of industrial partners, substantially accelerating the company’s technological development and commercialisation efforts. “TDK Ventures is proud to support Tulum Energy. The company’s revolutionary turquoise hydrogen production process, based on an ingenious reuse of mature industrial technology, offers a unique, scalable and cost-effective path to decarbonising heavy industries, which represent very large end markets. We are excited to leverage our global network to accelerate Tulum Energy’s technology development and commercialisation and help the company become a pillar of the clean hydrogen economy,” said David Delfassy, investment director at TDK Ventures.

ALL RIGHTS RESERVED ©