Table of contents

- The value of venture capital transactions will grow in 2025

- How is the rest of the ecosystem doing?

- Regional dynamics, the year of the suburbs

- Resilient negotiation on difficult comparables

- Risks

- The historic low in fundraising is a critical point for Europe

- The United Kingdom and Ireland lose their top spot to the DACH region for the first time

- Uncertain prospects

Pitchbook has published the new edition of the European Venture Report on venture capital investments on the continent during 2025. Below is the analysis.

Five key themes characterised 2025: AI as a dominant force in European technology, lack of liquidity, secondary markets moving from niche to necessity, fundraising experiencing its most difficult year on record, and geopolitical issues: tariffs, defence reshoring and macroeconomic policy.

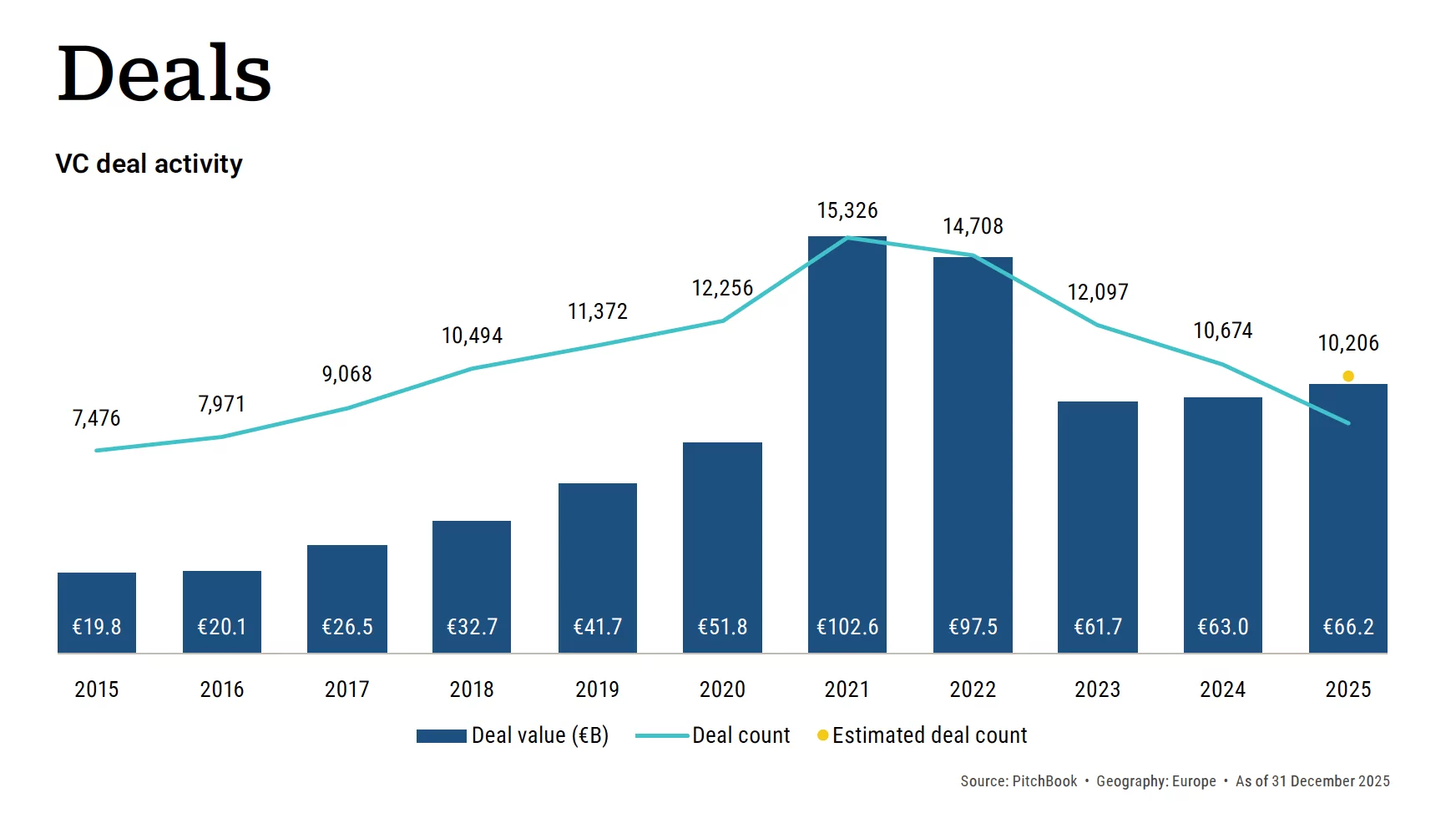

The venture capital landscape in Europe saw a growing divergence between different ecosystems and sectors during 2025. The value of European deals grew in 2025, while the number of transactions continued to decline. Activity was driven by fewer but larger late-stage funding rounds. At the sector level, it is clear that AI has caused the main bifurcation in market trading areas.

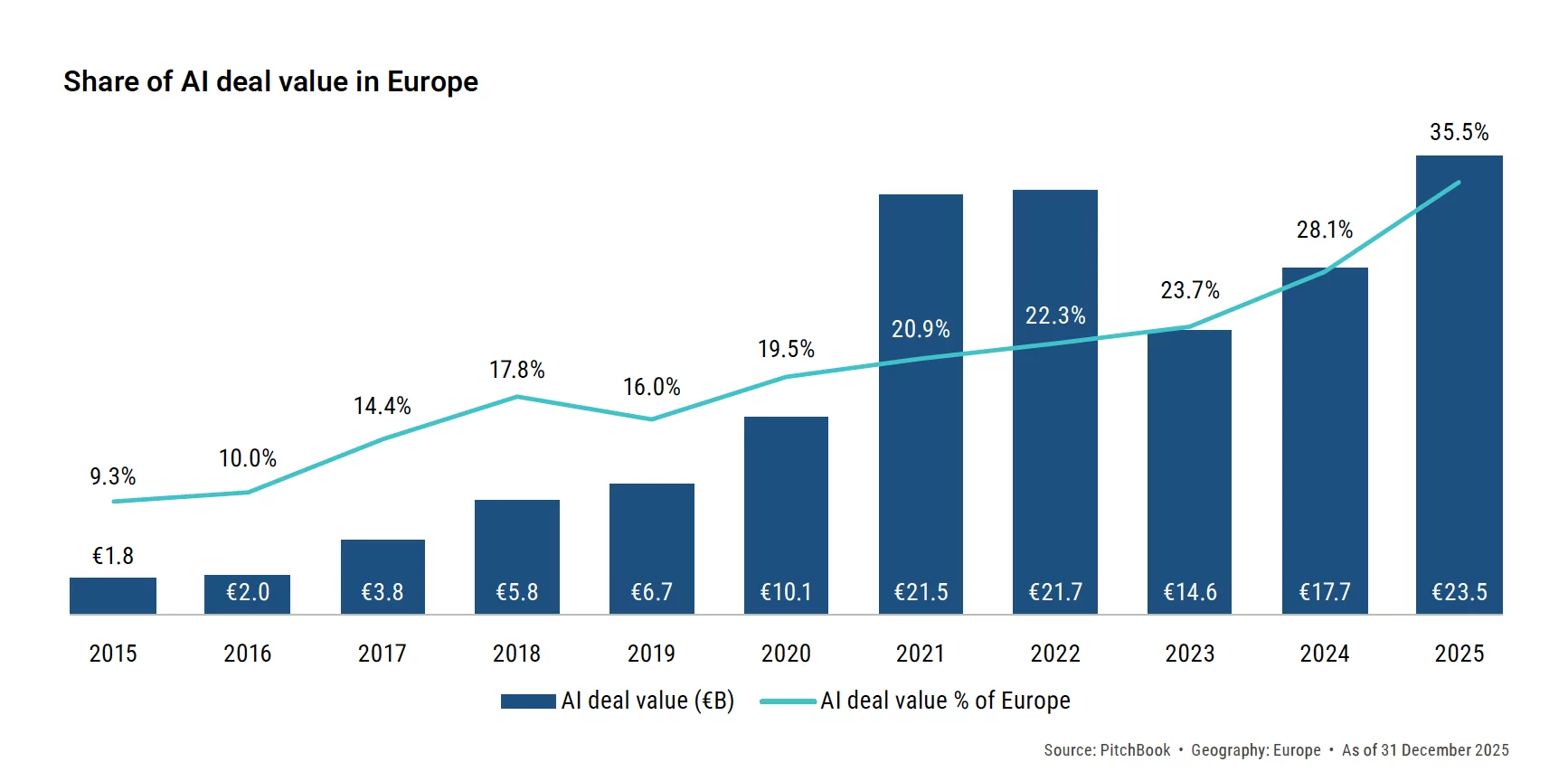

AI-related deals now account for 35.5% of the value of deals in Europe, making the ecosystem more delicately balanced between AI-related and non-AI-related sectors. Therefore, the big questions for 2026 are: is there an AI bubble? And if so, could we see it burst in 2026? Any change in sentiment towards AI valuations could spill over into the broader venture landscape, testing the resilience of non-AI sectors that have only recently begun to regain momentum. This also raises the question of how resilient the European venture capital market would be without its dependence on bubble-like valuations. In 2025, excluding AI, the underlying market showed more subdued dynamics, as several verticals lost momentum and core regions saw flatter growth, while peripheral markets benefited from concentrated and larger deals.

Trends in fundraising and the rest of the ecosystem were also divergent, with fundraising hitting an all-time low, while deal activity and exit value were more resilient on an annual basis. In terms of exits, a handful of large IPOs and acquisitions drove overall value, while broader liquidity conditions remained weak. Exit volumes continued to trend downward, and M&A-dominated activity highlighted the ecosystem’s continued reliance on a small group of transformative deals to sustain momentum. As liquidity remains depressed and the underlying exit market (excluding Klarna) showed limited growth, limited distributions to LPs continued, reinforcing a challenging environment for investment in the sector. Fundraising reached an all-time low, as investment shifted towards smaller vehicles and emerging managers, resulting in compressed fund sizes and slower closings.

Regional leadership has changed as traditional centres have lost ground, and despite a significant amount of available capital, modest returns and limited distributions raise questions about how quickly fundraising can recover without a significant improvement in liquidity. Taking a further step back, the above has occurred in a more uncertain geopolitical and macroeconomic environment, with talk of rate rises in Europe in 2026, following an accommodative 2025. A lower interest rate environment could be beneficial for trading activity in asset classes such as venture debt, as companies seek more favourable financing rates and the cost of financing decreases. The value of venture debt transactions has already proven relatively robust in 2025, despite declining volumes, supported by larger transactions and a growing share of late-stage borrowers raising funds. The resilience of the business is evident despite improving conditions for IPOs and easing monetary conditions.

The value of venture capital transactions will grow in 2025

The value of transactions in 2025 stood at €66.2 billion, an increase of 5.1% compared to 2024, thanks to stronger activity in the fourth quarter until the end of the year. 2025 was a year characterised by the relationship between value and volume: European venture capital markets continued to see a significant decline in deal volumes (20.6% less than the previous year), but value remained stable thanks to an increase in the size of individual deals.

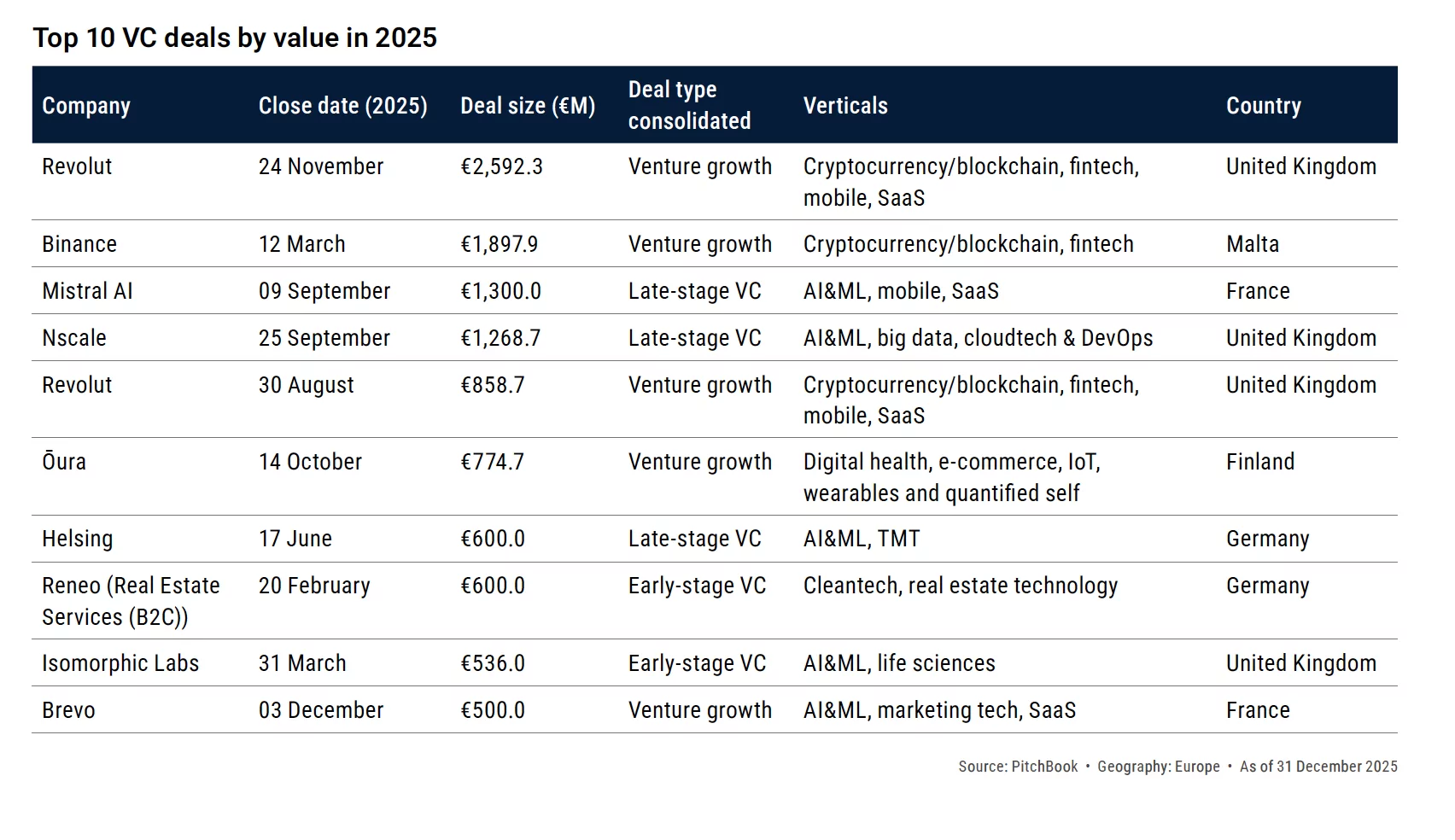

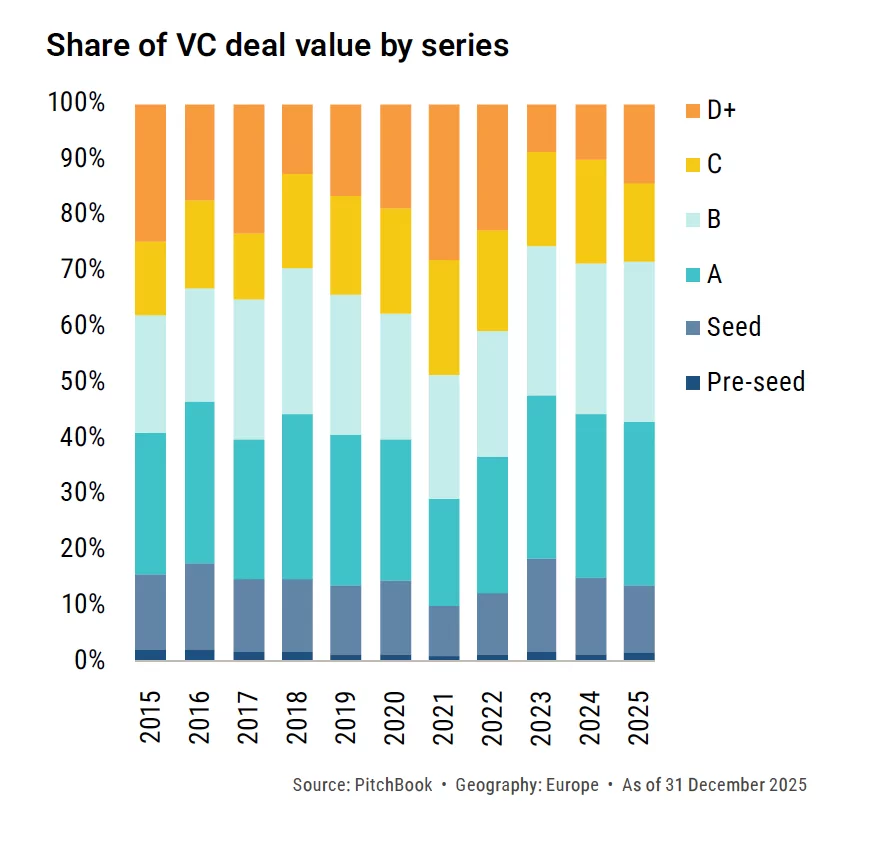

The picture was also mixed in terms of the different investment stages: both the seed stage and Series C recorded the most significant declines in value on an annual basis, with double-digit declines, while the later stages, from Series D onwards, recorded the largest increase, with a 45.2% rise thanks to growth in average investment values. In the fourth quarter of 2025, in particular, the most significant transactions included a megadeal by Revolut and Ōura’s €775 million round in October, a rare position for a purely consumer company, especially one not linked to artificial intelligence. Similarly, a foodtech startup also made an appearance in the top 10 deals of the quarter: German online grocery store Picnic’s €430 million round followed other popular sectors such as artificial intelligence startup Brevo. Revolut’s €2.6 billion round, which closed in November and involved a secondary sale of shares, proved to be the largest deal of the year. Overall, in 2025, the largest deals after Revolut included artificial intelligence companies Mistral AI and Nsale, both of which raised more than €1 billion in a single round.

What would European venture capital be without artificial intelligence? In 2025, artificial intelligence was the dominant force in venture capital markets. In Europe, one-third of transactions during the year involved AI companies, with 35.5% of the value of European transactions concentrated in this sector. In absolute terms, this led to €23.5 billion in investment in the sector, surpassing the historical peaks of investment in the sector in 2021-2022, when market conditions and macroeconomic factors were very different from those of today. The rate of investment in this sector is therefore evidence of the level of demand that the vertical has demonstrated. The value of transactions grew by 32.6% in an environment where financing conditions are difficult and non-AI-related verticals are being excluded.

Although the continued resilience of artificial intelligence in Europe may come as no surprise, its share of the value of European transactions is still around one-third of that in the United States (65.4%). It is rare for a single vertical sector to dominate the market for an extended period. There is clearly more room for growth in Europe, as this trend is considered to be one of the most important, if not the most important, structural changes in global technology markets and is expected to remain so in the long term.

However, questions remain about valuations and how carefully the fundamental business propositions of AI-related start-ups are being scrutinised. We believe that AI start-ups should be distinguished based on the percentage of their business that relates to pure AI software, i.e. where the core intellectual property of their business lies in AI technology, as opposed to start-ups that use AI for more functional add-ons to legacy software. The big questions heading into 2026 are therefore: is there an AI bubble and a rationalisation in the number of AI players in Europe? If so, when will it burst and rationalisation occur? And how resilient is the European venture capital market without the support of speculative bubble-like valuations? Regarding the latter question, excluding the ‘AI effect’ in Europe, we estimate that the underlying venture capital market will decline, with a 5.7% year-on-year decrease in investments, totalling £42.7 billion in 2025. It is not only this year that the vertical sector is supporting the market. In 2024, investments in artificial intelligence were also substantial, accounting for 28.1% of the value of transactions. However, excluding the impact of artificial intelligence, the underlying value of European venture capital transactions in 2024 also declined by a low single digit compared to the previous year.

How is the rest of the ecosystem doing?

This highlights the issue of the resilience of a European ecosystem that is not linked to AI. Since the beginning of the year, we have seen capital flowing into other sectors in Europe. Performance has been mixed in other areas of the ecosystem, and it is also difficult to monitor, as our vertical sectors are not mutually exclusive and, therefore, AI overlaps with others.

We saw a remarkable recovery in key sectors such as fintech at the end of the year, with investments totalling €13.4 billion, up 29.3% year-on-year, albeit helped by a massive €2.6 billion funding round by Revolut. Excluding Revolut’s round, investments in the vertical remained resilient, demonstrating that the sector continues to be a key hub for deal-making in European markets and a potential beneficiary of the tailwinds of AI. The sector ranked third in terms of deal value last year, up from fifth place. Other sectors less related to artificial intelligence, such as life sciences, performed worse, with investments of €8.4 billion (down 6.2% year-on-year), underperforming the underlying market.

Transaction activity in the clean technology sector continued to fall in the rankings, dropping to sixth place at the end of the year, compared to fourth place in 2024. Climate technology also fell from seventh to eleventh place in 2025. Although the sector remains bifurcated, we believe that by the end of 2026, 50% of the value of transactions in Europe will be AI transactions (an increase of almost 10 percentage points year-on-year). The ecosystem therefore remains in a delicate balance. Any change in sentiment towards AI valuations could spill over into the broader venture landscape, testing the resilience of non-AI sectors that have only recently begun to regain momentum. We view this as a risk to our outlook for ecosystem development in Europe going forward.

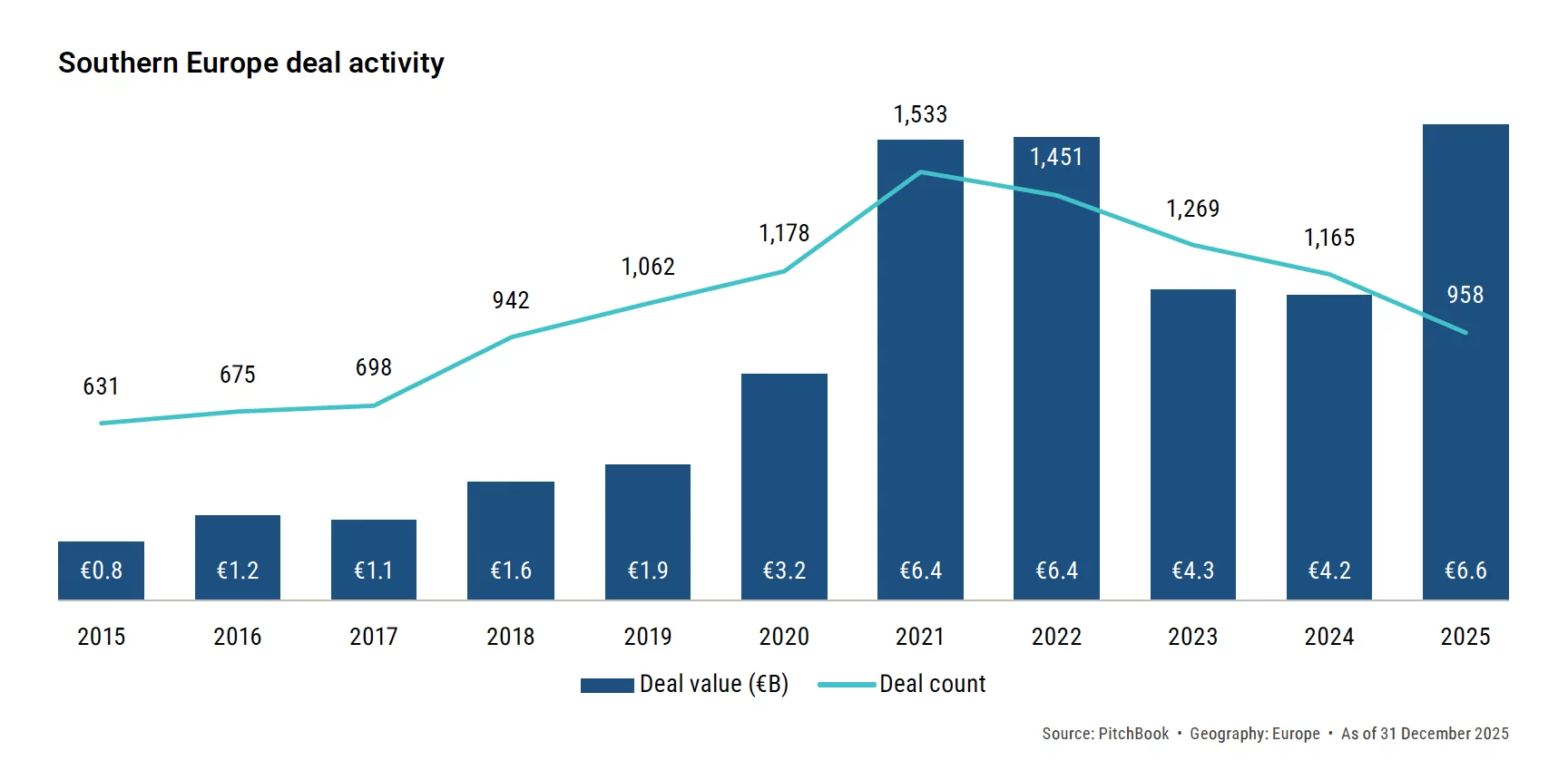

Regional dynamics, the year of the suburbs

In 2025, we saw growth in the share of European transaction value from non-core regions. Specifically, Southern Europe and Israel gained transaction value share, with the former recording its highest ever share of 10%. The resilience of activity was boosted by transactions involving Tekever and Spotawheel, based in Portugal and Greece respectively. The most significant transactions in Southern Europe are normally dominated by Spanish companies. Israel recorded the most significant growth in terms of transaction value compared to all other regions on an annual basis, albeit on a small scale, with €5.8 billion in investments in 2025. This was driven by large deals involving Cato Networks and AI 21 Labs, followed by a number of artificial intelligence companies. Half of the value of deals in Israel came from deals in the artificial intelligence sector in 2025. Major regions such as France and Benelux, Germany, Australia and Switzerland (DACH) lost momentum and lagged behind other regions, where historical leaders, the UK and Ireland, experienced a year of flat growth, with deal value reaching £22.7 billion in 2025.

Resilient negotiation on difficult comparables

The value of venture debt transactions stood at €19.2 billion, marking a fairly resilient year of activity. This is a decline from the record year of 2024, but, as expected, we did not anticipate year-on-year growth this year given the absence of key players such as Northvolt, which drove trading activity last year. In 2025, value continued to prevail over volume, with a significantly lower number of transactions (506), close to historic lows (and a 35.8% decline year-on-year), but the value of transactions offset the decline. By stage, later stages continue to account for a share of the count, with growth companies also gaining the largest share in terms of value, now accounting for 37.2% of the number of debt transactions in this sector of the ecosystem. This is to be expected, given the value versus volume dynamics observed in the core business, as larger transactions gain a share of the business and are therefore likely to be picked up by larger companies. Furthermore, as the European ecosystem has matured, the nature of the companies raising debt has shifted towards later-stage companies. For example, five years ago, the percentage of debt transactions originating from venture growth operators was only 16.3%.

However, the increase in the average investment size keeps the activity resilient. In the fourth quarter, in particular, the most significant deals included €758 million raised by real estate company Vivion, followed by €500 million by clean technology company Elvy and then €250 million by French insurtech start-up Groupe Covea. Overall, 2025 saw deals exceeding €1 billion from United Petfood, Flix and Finn, with a significant number of deals exceeding €100 million during the year. This led to an increase in the median deal size, with larger deals gaining market share. As valuations in Europe increased during 2025, the size of transactions in the venture debt market also increased.

IPOs in Europe continued to remain depressed relative to historical levels of activity. We have previously noted that venture debt, as an asset class, has seen significant growth in Europe as mature start-ups seek financing options outside of equity markets. Despite the dip in 2025, deal value remained resilient relative to historical peaks. Although IPO markets began to heat up in the second half of 2025, we believe that a more accommodative macroeconomic policy environment is also likely to favour debt refinancing. The US Federal Reserve cut rates by 25 basis points in September, the first cut since December 2024. The Federal Reserve’s rate cuts have been much slower than those of the European Central Bank and the Bank of England, which have made four cuts this year.

Risks

Our thesis presents risks and nuances depending on the sector, region and asset class. The most direct impact on the IPO window will be any changes to its two pillars: valuations and volatility. If technology valuations undergo a correction, for example due to the bursting of an artificial intelligence bubble, this could cause a broader wave of selling in technology stocks. Furthermore, outside the equity markets, if specific exogenous macroeconomic factors, such as geopolitics and unexpected changes in macroeconomic policy, were to cause an increase in volatility, this would once again weigh on share prices. Our thesis focuses on the European market, but in the United States the dynamics have been and will be very different. In the US, interest in growth companies is greater thanks to their more established ecosystem of publicly traded technology companies. In Europe, the type of company will determine the propensity for public financing and profitability, with AI companies expected to continue their bifurcation in exit markets and find a more favourable propensity for listing than non-AI companies. Furthermore, the standard of profitability is likely to be lower if listings are more AI-oriented. Finally, the risks to our thesis may relate to differences between asset classes. Historically, we have seen more PE-backed listings and a profitable flow, while VC-backed listings have been fewer and less profitable. The exit environment and IPO flow for each asset class are therefore key determinants of the level and nature of listings we may see next year. With the improvement in VC-backed listing markets, we may see fewer but profitable listings, such as Klarna.

The historic low in fundraising is a critical point for Europe

Fundraising in Europe closed the year at €12 billion across 148 vehicles, with activity levels at historic lows in terms of both value and volume. Fundraising trends this year were driven by a reduction in median fund size, which is now 16.3% lower than in 2024, when the closing of mega-funds and a preference for experienced firms led to a record median fund size. The dynamics in 2025 were very different. Emerging managers gained a significant share of capital raised, accounting for 44.7% compared to 40.3% in 2024, although these managers maintained their share of the total number at 67.6%. Nevertheless, fewer funds were closed on their debut, with only 27.7% of vehicles raising capital for the first time. However, as expected, small vehicles gained market share, as there were no closings exceeding €1 billion in 2025 and only three closings exceeded €500 million. These included Sofinnova Capital, which raised €650 million in November; Medicxi’s fifth fund, which raised €500 million in the same month; and Cherry Ventures, which raised €500 million at the beginning of the year. All three closings represent the most important regions for capital in Europe, with Paris, London and Berlin continuing to dominate the European fundraising landscape, although their ranking appears to have changed this year.

The United Kingdom and Ireland lose their top spot to the DACH region for the first time

The dynamics of capital raising by region saw the UK and Ireland lose their leadership in terms of share of capital raised to the DACH region. Fundraising in the UK saw a significant increase in 2024, driven by several mega-funds, resulting in a share of capital raised of almost 40%. As fundraising cycles are longer than a year, this phenomenon did not repeat itself in 2025. The UK’s share of capital declined, but to levels well below the region’s historical norms, settling at 22.5% in 2025, the lowest ever recorded. However, at the same time, we saw an increase in the DACH region’s share of capital, which reached 26.9% in 2025, thanks to large closings by Hitachi Ventures in Munich (€386.6 million) and Project A Ventures V in Berlin (also over €300 million). Four of the top ten deals closed this year were based in Germany and only two in the UK, indicating broader trends among the larger regions. 2025 is the first year we have seen an established region, the UK, not top the capital raising table in Europe. The other dominant region, France and Benelux, merely maintained its share of capital raised in 2025. As other regions, such as Central and Eastern Europe and Israel, gain capital shares in a still sluggish European environment, questions arise about the composition of assets across regions in the future.

Cyclical or structural recession? The debate over whether cyclical or structural factors will drive capital raising in Europe in the future remains open. On the one hand, capital raised in Europe has shown reasonable resilience after the market correction in 2021 and 2022, when several mega-funds that supported activity last year were closed, but are unlikely to be repeated in the next 18 months. On the other hand, the cyclical argument loses momentum when comparing capital raised levels to the pre-2021 hype of 2020. Furthermore, given that the venture capital market has grown significantly since COVID-19, but capital raised since the correction is at similar levels, it could be argued that European fundraising has not kept pace with the growth of the rest of the ecosystem.

Uncertain prospects

Regardless of one’s position, it is clear that returns on entrepreneurial ventures in Europe have lagged behind, making it difficult for LPs to allocate capital ahead of 2026. However, there is still capital to be raised, with the top 20 venture capital funds open at the end of 2025 amounting to €14.9 billion. It is unclear when these funds will close, but if they do so in 2026, this would support this year’s total fundraising. However, the conclusion is that distributions will need to increase before the fundamental factors underlying capital raising can drive funding, as well as other areas of the ecosystem. Net LP cash flows for VC globally have recovered from the lows of previous years but remain below historical averages. Capital invested in European start-ups, therefore, stands at increasing multiples of capital raised by European funds, at 6.3 times in 2025 compared to just 3.2 times in 2024. For capital raised to recover in 2026, it is essential that returns and distributions improve.

ALL RIGHTS RESERVED ©